What is a virtual IBAN account?

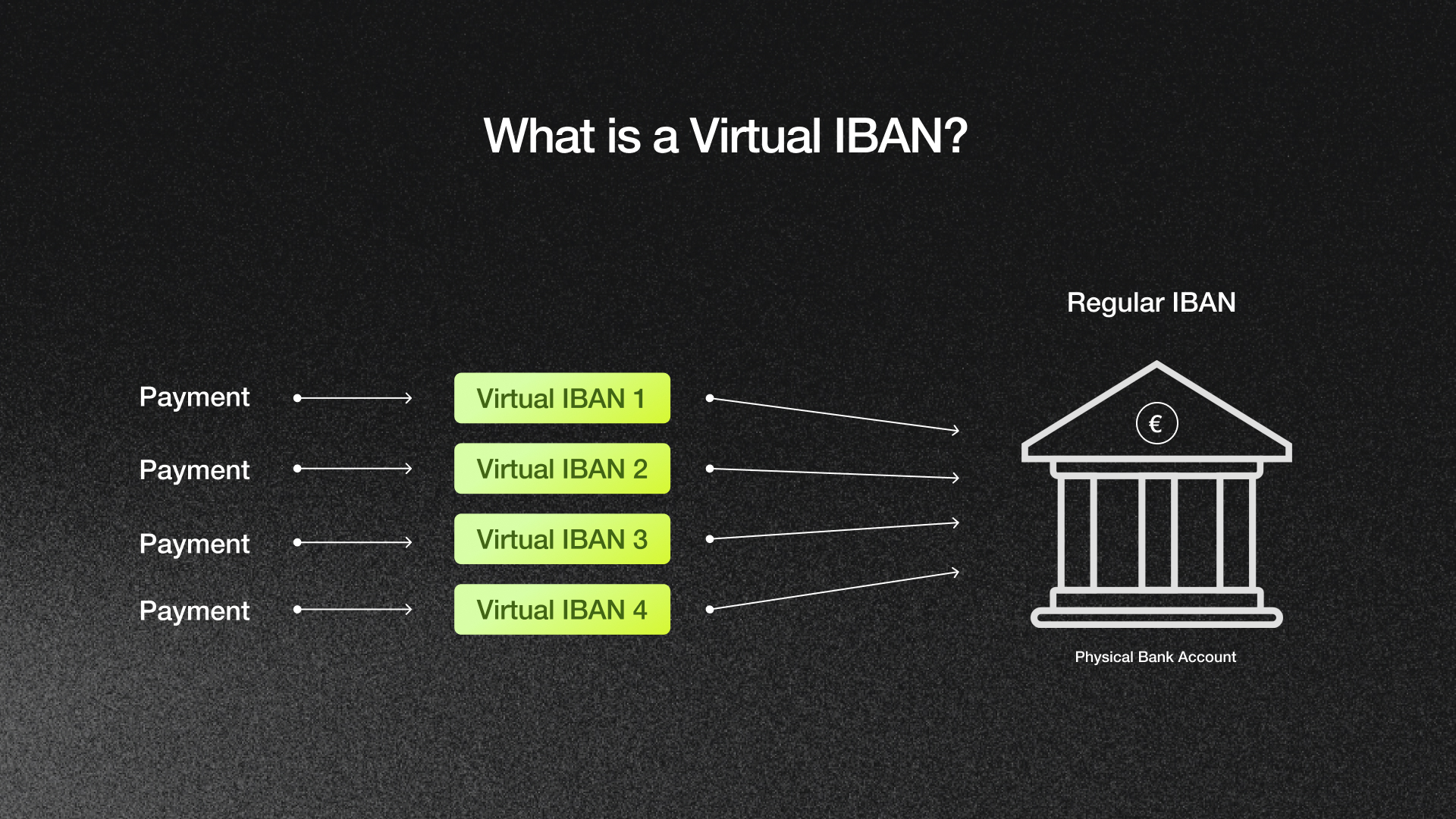

A virtual IBAN (International Bank Account Number) is a unique account reference number provided by a banking or payment institution. Unlike a traditional IBAN tied to a physical bank account, a virtual IBAN is not directly linked to a specific bank branch. Instead, it acts as a reference that allows businesses to receive and manage payments locally without the need for a physical presence.

How does a virtual IBAN differ from a regular IBAN?

Virtual IBANs provide an extra layer of anonymity and security, as they do not reveal the underlying account details during transactions.

- Regular IBAN: Directly linked to a physical bank account, used for traditional banking transactions.

- Virtual IBAN: Linked to a virtual account, facilitates more efficient management of incoming payments, especially for businesses operating in multiple regions, since a virtual account can contain several local virtual IBAN’s for individual countries.

Regular IBANs are typically used for simple international transactions, where money is moved from one account to another.

On the other hand, virtual IBAN accounts are beneficial for businesses involved in cross-border trade or handling multiple currencies. They allow businesses to assign specific vIBANs for clients, projects, or departments, simplifying fund management and facilitating the monitoring of financial flows.

How a virtual IBAN can help your business

Implementing virtual IBANs can offer numerous advantages for businesses, including:

- Streamlined Payment Processes: Simplify the reconciliation of incoming payments by assigning unique IBANs to different clients or transactions.

- Cost Efficiency: Reduce the costs associated with international transactions by using local IBANs for cross-border payments.

- Enhanced Security: Increase security and privacy, minimising the risk of fraud by masking the primary account details.

- Scalability: Easily scale your business operations without the need for multiple physical accounts.

Demand from different parties - Examples

Tech Startups

Example: A tech startup with a global customer base can streamline subscription payments and reduce costs associated with currency conversions using virtual IBANs.

Crypto Brokers

Example: A cryptocurrency brokerage platform can leverage virtual IBANs to facilitate seamless fiat-to-crypto transactions for their global client base, enabling clients to deposit funds in their local currencies, which can then be easily converted to cryptocurrencies, improving transaction speed and reducing currency exchange fees. This can also reduce extra fees from having to use SWIFT as a payment rail.

Educational Institutions

Example: A university with international students can use virtual IBANs to manage tuition fee payments in different currencies, improving the efficiency of their financial operations.

Real Estate Companies

Example: A real estate firm dealing with international property buyers can use virtual IBANs to receive payments in the buyers’ local currencies, reducing the complexities of currency exchange.

The real world example of Booking.com:

Booking.com leverages virtual IBANs to streamline its payment processes and enhance operational efficiency. Here’s how they utilise virtual IBANs:

- Simplified Payment Collection:

- Process: When customers make bookings, payments can be directed to a virtual IBAN assigned to the specific transaction or property.

- Benefit: This allows Booking.com to easily track payments, ensuring that each transaction is correctly attributed to the right property and reservation.

- Multi-Currency Management:

- Process: Booking.com operates globally and deals with multiple currencies. Virtual IBANs facilitate the collection of payments in various local currencies.

- Benefit: This reduces currency conversion costs and complexities, providing a smoother experience for both customers and property owners.

- Automated Reconciliation:

- Process: Payments received through virtual IBANs can be automatically matched with booking details.

- Benefit: This reduces manual reconciliation efforts and errors, speeding up the financial processing and improving accuracy.

- Enhanced Transparency and Reporting:

- Process: Virtual IBANs provide detailed transaction reports, making it easier for Booking.com to monitor and audit payments.

- Benefit: This transparency helps in maintaining financial integrity and simplifies compliance with regulatory requirements.

- Reduced Operational Costs:

- Process: By using virtual IBANs, Booking.com can reduce the need for multiple traditional bank accounts and associated fees.

- Benefit: This leads to significant cost savings and more efficient financial management.

Virtual IBAN providers

As always in business, choosing the right partner, in our case a virtual IBAN provider, is very important. What should you look out for? Make sure the provider offers seamless integration with your existing financial systems AND has solid Customer Support. The reputation and reliability and positive customer reviews will give you a first impression.

Leading international IBAN Providers

While several providers offer international IBAN services, Januar stands out for its comprehensive offerings and user-friendly platform:

- Januar: Known for its exceptional service and innovative solutions, Januar provides virtual IBAN options tailored to various business needs with a strong focus on crypto businesses.

- Revolut: Offers competitive rates, a strong focus on security, and an easy-to-use platform, making it a popular choice for businesses seeking efficient financial solutions.

- Wise: Known for its extensive network, global reach, and low fees, Wise is ideal for businesses looking to manage cross-border transactions seamlessly.

What virtual IBANs can Januar offer?

Januar offers virtual IBANs in multiple currencies, allowing businesses to manage their finances more effectively. Available currencies include EUR, DKK, and more, ensuring compatibility with global operations. Januar also offers virtual IBANs in several local countries including DK, DE and LU.

How to create a crypto IBAN Account with Januar

Creating a virtual IBAN with Januar is a straightforward process:

- Sign Up: Visit the Januar website and complete the registration form.

- Verification: Submit the required documents for verification.

- Account Setup: Once verified, select the desired virtual IBAN and currency.

- Integration: Integrate the virtual IBAN with your existing financial systems.

Ready to get started? Create your account now.

FAQ about virtual IBAN

What is a virtual IBAN?

A virtual IBAN (International Bank Account Number) is a specialised bank account number that allows businesses to receive payments directly into their account. It allows businesses and individuals to receive and manage payments more efficiently without needing multiple physical bank accounts.

What is virtual vs physical IBAN?

A virtual IBAN is a unique account number not tied to a physical bank branch, whereas a physical IBAN is linked directly to a specific bank account.

Why should I have a virtual IBAN?

Depends on your financial needs and business model. Here are some key reasons why you might consider having a Virtual IBAN: simplified global transactions, cost-effectiveness, improved cash flow management, increased flexibility, enhanced security, ease of use, global reach.

How to create a virtual IBAN?

Sign up with a virtual IBAN provider, complete the verification process, and select your desired virtual IBAN.

Can I receive international payments with a virtual IBAN?

Yes, virtual IBANs can be used to receive both domestic and international payments, making them ideal for businesses with global operations.

What are the benefits of virtual IBANs for local payments??

Having a local IBAN for payments can eliminate hefty international transfer fees for customers, ensuring smooth and cost-effective transactions. While a VIBAN is great for international payments, there are real benefits also in making local transactions seamless and affordable.

Is a virtual IBAN secure?

Yes, virtual IBANs are secure. They operate within the framework of traditional banking systems and comply with all relevant regulations and security protocols.

To explore the benefits of virtual IBANs and start leveraging them for your business, visit the Januar Account page

If you would like to know more about investing in crypto, we have also provided guides as to how to open a crypto account as well as how to buy crypto. Once you are ready to start investing in crypto, you can create your very own Januar Account here.

Disclaimer

The information provided in this article is intended solely for general informational purposes and should not be interpreted as professional advice from Januar. Please be aware that Januar is not a financial advisor. We strongly recommend that individuals seek independent guidance from qualified legal, financial, or accounting professionals before making any cryptocurrency investment decisions.